Providing an overview of what inflation is and its impact on the economy.

Embarking on the economic journey, understanding inflation becomes paramount. What drives prices upward, and how does it impact our financial landscape? In this article, we unravel the intricacies of inflation—its definition, causes, and the delicate dance it shares with unemployment. Join us as we explore the pivotal role of interest rates, the metrics used to measure inflation, and the historical footprints that guide our understanding. This journey is not just about numbers; it’s a roadmap to comprehend the forces shaping our economies and financial decisions.”

Factors Driving Inflation

Inflation is a complex economic phenomenon influenced by a multitude of factors. This section navigates through the key drivers that contribute to the rise in prices. Monetary police. Central banks control the money supply and interest rates and are powerful tools that impact inflation. External factors like changes in global commodity prices or geopolitical events also play a crucial role. Increased demand for goods and services or production costs are examples of internal factors that can stimulate inflation.

Readers will gain insights into how these interconnected factors create a dynamic environment where inflation can either surge or be kept in check. By understanding the diverse forces at play, individuals can better comprehend the nuanced landscape in which inflation operates, enabling them to navigate its implications more effectively.

Inflation and Unemployment Dynamics

The relationship between inflation and unemployment is a central aspect of economic analysis, often encapsulated in the Phillips curve. This section explores how these two economic indicators are interconnected When both inflation and unemployment are typically high at the same time. A phenomenon known as the Phillips curve trade-off takes place. However, there are a lot of moving parts in this relationship, including laws and expectations from the government, so it’s not always clean and dry.

Comprehending the interplay between inflation and unemployment affords policymakers a sophisticated outlook on the obstacles they confront. Although high inflation can boost the economy, it can also have unfavorable effects like reducing purchasing power. This section clarifies the complex relationship between unemployment and inflation. Highlighting the trade-offs and difficulties involved in controlling these economic factors.

Role of Interest Rates in Inflation Control

Adjusting interest rates stands as a pivotal tool in the arsenal of policymakers striving to manage inflation. This section explains the process of raising interest rates to lessen inflationary pressures. Central banks, such as the Federal Reserve. Employ interest rate hikes as a tool to cool an overheating economy by making borrowing more expensive. In turn, this lowers corporate investment and consumer expenditure, which helps to combat inflation.

The intricate balancing act that central banks undertake to preserve price stability without impeding economic progress will become clearer to readers. Understanding interest rates’ function in the battle against inflation helps people prepare for possible effects on their financial situations and respond to monetary policy changes with knowledge.

Government Policies and Inflation

Government policies play a significant role in influencing the trajectory of inflation. This section examines how fiscal and monetary policies enacted by governments impact the overall price levels in an economy. Fiscal policies, involving government spending and taxation, can stimulate or cool down economic activity, affecting inflation. Meanwhile, central banks, through monetary policies, regulate the money supply and interest rates to manage inflation.

Readers will gain insights into the proactive measures governments take to control inflation, especially during economic instability. The potential trade-offs between achieving price stability and fostering economic growth are explored. Understanding the intricate relationship between government policies and inflation empowers individuals to anticipate economic trends and make informed decisions in response to policy changes.

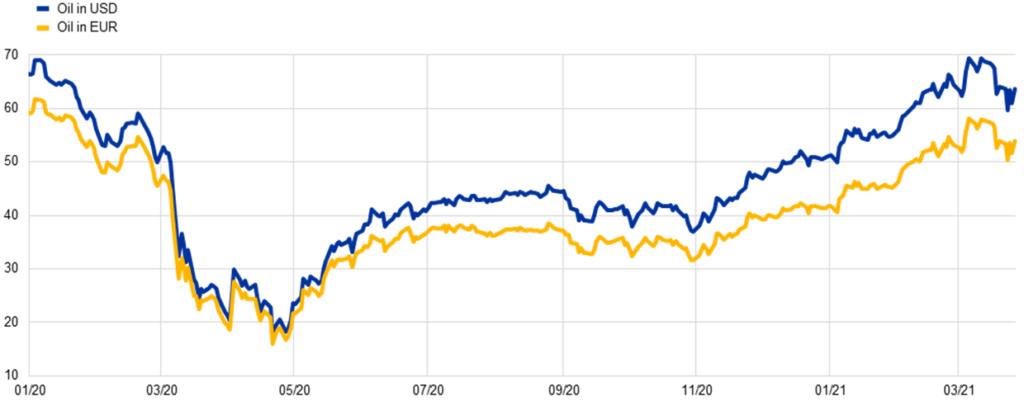

Global Economic Factors and Inflation

In an interconnected global economy, inflation is not solely influenced by domestic factors. This section explores how a country’s inflationary trends are influenced by the state of the world economy. Changes in exchange rates, the price of commodities internationally, and shifts in the global demand for goods and services can all impact inflation rates in a country.

The understanding of how global events might impact local prices and inflation will be imparted to readers. Factors such as trade imbalances, geopolitical tensions, and international monetary policies contribute to the intricate relationship between global economic conditions and inflation. Understanding these external dynamics provides a more holistic view of the forces shaping inflation and equips individuals to navigate the complexities of a globally intertwined economic landscape.

Historical Perspectives on Inflation

Examining historical perspectives on inflation provides valuable insights into patterns, lessons learned, and the evolution of economic thought. This section traces key episodes of inflation throughout history, from hyperinflations to periods of relative stability. Case studies, such as the Weimar Republic in the 1920s or the more recent experiences of Zimbabwe, highlight extreme instances of inflation and their profound societal impacts.

By exploring historical contexts, readers gain a nuanced understanding of the various factors that can contribute to inflationary crises. The section also sheds light on how policymakers have responded to and learned from past inflationary episodes, contributing to the development of modern economic theories and practices. Understanding the historical backdrop of inflation enriches individuals’ perspectives and equips them to interpret current economic conditions more effectively.

Conclusion

Navigating the Causes and Effects of Inflation

In conclusion, navigating the landscape of inflation involves a comprehensive understanding of its causes, consequences, and the intricate factors that contribute to its ebb and flow. From the fundamental definition of inflation to the historical echoes of economic challenges. This exploration offers a holistic view of the phenomenon.

The delicate dance between inflation and unemployment, and the impact of global and governmental factors. Measuring inflation becomes a tangible concept, and the historical lens provides a backdrop for interpreting contemporary economic dynamics.